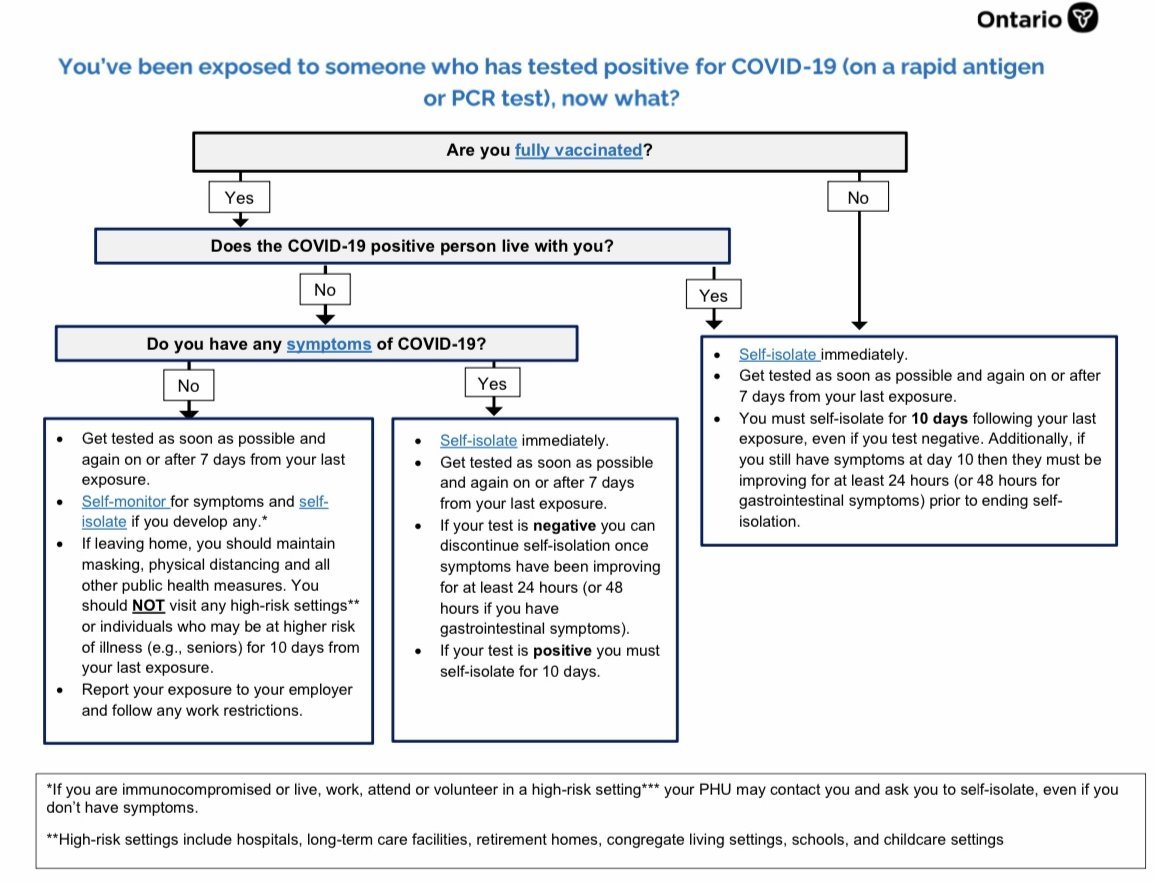

Possible COVID-19 exposure?

COVID-19 Helpful Resources:

Government of Ontario Covid self assessment test would be helpful:

https://covid-19.ontario.ca/index.html

Toronto Public Health Covid info:

https://www.toronto.ca/home/covid-19/

Here is a list of COVID-19 patient resources, click to go to section:

Food

Daily Bread Food Banks

List of Daily Bread-associated food banks – It is advisable to call the specific food bank first to either book an appointment or confirm if they are still open – https://www.dailybread.ca/need-food/programs-by-location/

Scarborough Food Security Initiative

- Provides food and supplies “while between pay cheques”

- Also delivers groceries and medication while self-isolating

Contact: ScarbCares@gmail.com or Call 647-846-0300

Catchment: Eglinton (N) to the Lake (S) and Victoria Park (W) to Markham Rd (E)

Source: https://scarboroughfoodsecurityinitiative.com/

Salvation Army – East Toronto Corps

Located at Woodbine/Danforth

Call 416-467-7416 to book an appointment or book online: https://saeasttoronto.setmore.com/

If a new client, need to bring proof of identity, address, income and expenses

Catchment: Those in postal codes M1L, M1N, M4B, M4C, M4E and M4L

Toronto Red Cross Mobile Food Bank

Delivers food to those unable to access a food bank due to a permanent or

temporary disability – M-F (8:30am-4:30pm) – 416-236-3180

Prepared/Frozen Meal Delivery

- East York Meals on Wheels: 416-424-3322, https://www.eastyorkmealsonwheels.org/

- Heart to Home Meals: 1-800-786-6113 , https://www.hearttohomemeals.ca/meals

Grocery Delivery

Grocery Gateway: https://www.grocerygateway.com/store/groceryGateway/en/

Instacart: https://www.instacart.com/

Metro: https://www.metro.ca/en/online-grocery

Sobeys Voila: https://voila.ca/

Walmart: https://www.walmart.ca/en

Support for Seniors

Friendly Neighbour Hotline

- Help seniors pick-up essential items (eg. groceries, medications)

- For low-income seniors in Toronto housing only at this time

Contact 1-855-581-9580 – Toll-Free and available in 180 languages. Available M-F, 9-5pm

Process: Call the hotline, let the volunteer know what you need (8 items or less), pick-up and pay with cash in the lobby (no delivery fees)

Source: http://uhnopenlab.ca/project/hotline/

Seniors Helpline

A single point of access for seniors and caregivers to access information

regarding community, home and crisis services

Call 416-217-2077 or Toll-Free 1-877-621-2077

Open M-F (9am-8pm) and Weekends/Holidays (10am-6pm)

Source: https://torontoseniorshelpline.ca/

Active Aging Canada Youtube Channel

A collection of videos created by Active Aging Canada on various physical activities and wellness:

https://www.youtube.com/c/ActiveAgingCanada/videos

Virtual Museum

Job Protection

The Employment Standards Amendment Act (Infectious Disease Emergencies), 2020 offers job-protected leave to employees in isolation or quarantine due to COVID-19 or to those who need to care for children due to school closures or to care for relatives.

The employee will not be required to provide a medical note to take the leave but may be required to provide other reasonable documentation.

The measures are retroactive to January 25, 2020 – date of first presumptive COVID-19 case in Ontario.

This applies to full-time, part-time, students, temporary help employees; it does not cover those under the federal jurisdiction (eg. those who work for banks, airports, inter- provincial rail and federal crown corporations).

Last Updated: March 30, 2020

Financial Supports

EI Sickness Benefits

For those in imposed quarantine, the one-week waiting period and provision of a medical certificate will be waived effective March 15, 2020

Telephone Inquiry Line: 1-833-381-2725

Apply here: https://www.canada.ca/en/services/benefits/ei/ei-sickness/apply.html

Canada Emergency Care Benefit (CERB)

Provides a taxable benefit of $2000/month for up to 4 months – Application will be available in April 2020 and will need to attest that they meet the eligibility requirements and will need to re-attest every 2 weeks to confirm eligibility

Eligible to:

- Workers who must stop working due to COVID-19 and do not have paid leave or other income supports

- Workers who are sick, quarantined or taking care of someone who is sick with COVID-19

- Working parents who must stay home without pay to care for children who are sick or need additional care due to school/daycare closures

- Workers who still have their employment but are not being paid as there is currently not sufficient work and their employer has asked them not to come to work

- Wage earners and self-employed individuals, including contract workers who would not otherwise be eligible for EI

This will be accessible through a secure web portal starting in early April – Applicants will also be able to access it via an automated telephone line or toll-free number *This replaces the previously announced Emergency Care Benefit and Emergency Support Benefit

EI Work Sharing Program

Provides EI benefits to:

- Those who are “core employees” (ie. year-round permanent full-time or part-time employees who are required to carry out everyday functions)

- Those eligible to receive EI

- Those who agree to reduce workers their normal working hours in order to share the available work – The maximum duration of the program has been extended from 38 weeks to 76 weeks

Goods and Services Tax Credit

For low- and modest-income families – One-time special payment by early May 2020. This will double the maximum annual GSTC payment. Average income boost will be approximately $400 for single individuals and close to $600 for couples. There is no need to apply for this; if eligible, you will receive it automatically.

Canada Child Benefit

Proposed increase in maximum annual CCB payments by $300 per child for

2019/20. The benefit will be delivered as part of the scheduled CCB payment in May. Those who already receive CCB do not need to re-apply.

Canada Student Loans

Proposed 6-month interest-free moratorium on the repayment of Canada Student Loans for all individuals in the repayment process

Registered Retirement Income Funds

Proposed reduction in required minimum withdrawals from RRIFs by 25%. This provide flexibility to seniors concerned with forced liquidation of RRIF assets to meet minimum withdrawal requirements.

Tax Flexibility

Return filing due date for individuals has been deferred until June 1, 2020. Any new income tax balances or instalments are deferred until after August 31, 2020 without incurring interest or penalties.

Electronic signatures will now be recognized as having met the signature requirements of the Income Tax Act; this applies to authorization forms T183 (CORP). If expecting to receive the GST or CCB, it is encouraged not to delay filing taxes.

Sources: https://www.canada.ca/en/department-finance/news/2020/03/canadas-covid-19-

economic-response-plan-support-for-canadians-and- businesses.html

Housing and Utilities

Property Tax and Utility Payments

The city is providing a grace period of 60 days for property tax and utility payments, starting March 16, 2020

Source: https://www.toronto.ca/home/covid-19/economic-support-recovery/economic-support-recovery-for-individuals-families/

Last Updated: March 30, 2020

Property Tax Appeal: Sickness or Extreme Poverty

A one-time or temporary relief by cancellation or reduction of property taxes due to financial hardship

Eviction

The Landlord and Tenant Board is suspending all hearings and issuance of eviction orders, unless deemed an urgent issue such as illegal acts or serious impairment of safety

Source: http://www.sjto.gov.on.ca/en/latest-news/

Toronto Hydro

The Government of Ontario is providing a temporary 45-day emergency relief – This means, as of March 24, 2020, those who pay time-of-use (TOU) electricity rates will be charged the off-peak rate of 10.1 cents per kWh for 45 days, no matter what time of day the electricity is consumed.

As well, there will be an extension of current suspension of electricity disconnections for residential and low-volume small business customers until July 31, 2020. To discuss bill and payment options, call 416-542-8000

Source: https://www.torontohydro.com/covid-19

Low Income Energy Assistance Program

Low-income clients behind on their energy bills can receive an emergency assistance of up to $500 for electricity bills and $500 for natural gas bills

Ontario Electricity Support Program

Low income customers can receive a monthly credit to lower their electricity bills

Source: https://ontarioelectricitysupport.ca/

Toronto Shelters/Respite Centres

Central Intake Line: 416-338-4766 or 1-877-338-3398

Source: https://www.toronto.ca/community-people/housing-shelter/homeless-help/#respitesites

Mental Health

Walk-In Counselling

- Woodgreen – Walk-In Counselling services by phone

https://www.woodgreen.org/services/programs/walk-in-counselling/

Tuesdays and Wednesdays beginning at 4:15pm (416) 645-6000 ext. 1990 - Skylark – Walk-In Counselling services by phone

http://www.skylarkyouth.org/what-we-do/programs-counselling-services/walk-in-clinics/

Mondays: 10-6pm- From 9-1:30pm call 416-482-0081 and press 6, from 1:30-6pm call 416-482-0081 and press 5

Tuesdays: 10-6pm- From 9-1:30pm call 416-482-0081 and press 6, from 1:30-6pm call 416-482-0081 and press 5

Wednesdays: 12-8pm- From 11-7pm call 416-482-0081 and press 6

Thursdays: 2-6pm- From 1:30-6pm call 416-482-0081 and press 5

Fridays: 10-3pm- From 9:30-1:30 call 416-482-0081 and press 6

Crisis/Distress Helplines

- Toronto Distress Centre – confidential helpline for all ages https://www.torontodistresscentre.com/home-support

Available 24/7, expect longer wait-times 416-408-4357 - Gerstein Centre – confidential helpline for all ages http://gersteincentre.org/

Available 24/7, expect longer wait-times and no mobile services 416-929-5200 - Toronto Senior’s Helpline – confidential helpline for seniors wanting resources and counselling Monday-Friday 9-8pm, Sat-Sun & Stat Holidays- 9am-6pm https://torontoseniorshelpline.ca/

Call: 416-217-2077 or 1-877-621-2077 - Kids HelpPhone – confidential helpline for children and youth

Available 24/7, expect longer wait-times https://kidshelpphone.ca/

1-800-668-6868, Text CONNECT to 686868, or use Live Chat via website - Assaulted Women’s Helpline– confidential helpline for women experiencing abuse http://www.awhl.org/

Available 24/7, 416-863-0511, Toll-Free 1-866-863-0511, Toll-Free TTy 1-866-863-7868, or via Text #SAFE (#7233)

Helpful Websites And Articles On Coping With Stress & Anxiety

- CAMH– Mental Health and the COVID-19 Pandemic

https://www.camh.ca/en/health-info/mental-health-and-covid-19 - Anxiety Canada

https://www.anxietycanada.com/articles/what-to-do-if-you-are-anxious-or-worried-about-coronavirus- covid-19/ - American Psychological Association

https://www.apa.org/helpcenter/pandemics - Centres for Disease Control and Prevention

https://www.cdc.gov/coronavirus/2019-ncov/daily-life-coping/managing-stress-anxiety.html?CDC_AA_refVal=https%3A%2F%2Fwww.cdc.gov%2Fcoronavirus%2F2019-ncov%2Fprepare%2Fmanaging-stress-anxiety.html - UC Berkeley

https://greatergood.berkeley.edu/article/item/greater_good_guide_to_well_being_during_coronavirus - BBC

https://www.bbc.com/news/health-51873799?fbclid=IwAR3Q_Ff3bNdlUsyc0v1CUXYK7TvJ5sgA_77ygcPWpsZLRu-l4YsNFhv7dKc

https://ca.portal.gs/ - Health and Wellness Activities During Challenging Times

https://thedermreview.com/health-and-wellness-activities-during-challenging-times/

There are a few short ‘e-courses’ on different topics (e.g. stress, mood, anxiety), interesting articles, skill building activities, as well as links to peer support groups and community.

Mindfulness Resources

- Mindful – website with information, meditations, and other helpful resources

https://www.mindful.org/free-mindfulness-resources-for-calm-during-covid-outbreak/

https://www.mindful.org/covid-anxiety-is-also-contagious-heres-how-to-calm-down-america/

https://www.mindful.org/mindfulness-meditation-anxiety/ - Tara Brach– mindfulness information and free course to learn how to meditate https://www.tarabrach.com/mindfulness-daily/

- Centre for Mindfulness Studies – https://www.mindfulnessstudies.com/meditations/

- UCLA Health https://www.uclahealth.org/marc/body.cfm?id=22&iirf_redirect=1

- Jack Kornfield- https://jackkornfield.com/pandemic-resources/

Yoga Resources

- Yoga with Adriene- free yoga videos https://www.youtube.com/user/yogawithadriene

Self-Help Resources:

- Big White Wall– Mental Health education, resources, peer support https://www.bigwhitewall.com/

- Tolerance for Uncertainty: A COVID-19 Workbook by Dr. Sachiko Nagasawa https://41c01c68-7228-4f31-8b39-14b7008c74a3.filesusr.com/ugd/448e3c_d86c020a1e794606ba80f93893183aea.pdf

Wellness Apps

- Stop, Breathe, Think – also a youtube page

- Calm

- Breathe

- Insight Timer

- Mindshift

- Headspace